Tax Preparation Assistance

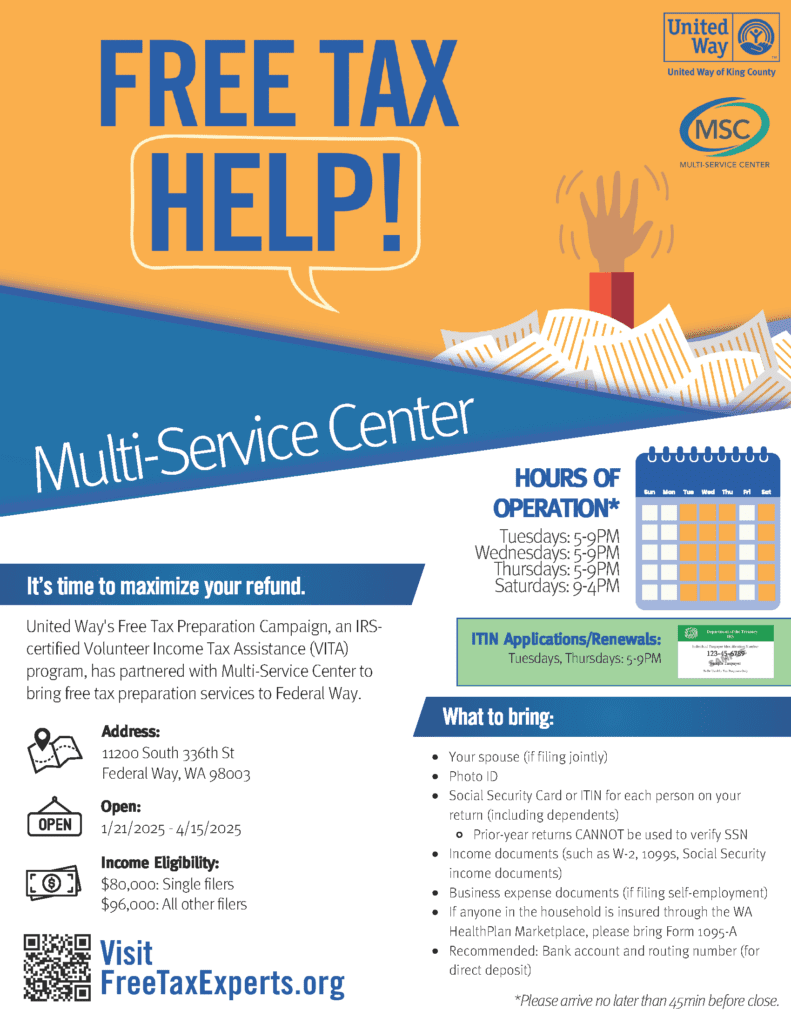

Need help with your taxes? United Way of King County’s Free Tax Preparation Campaign is providing tax assistance at MSC! Their IRS-certified volunteers are available on site at MSC’s Federal Way office during the following days and times between January 21 and April 15, 2025:

Tuesdays, 5:30-9pm

Wednesdays, 5:30-9pm

Thursdays, 5:30-9pm

Saturdays, 9am-4pm

Services are offered on a first come, first served basis. No early check-in and the last check-in will be 45 minutes prior to closing. Please bring the following with you:

- Spouse (if filing jointly)

- Social Security Card or ITIN for each person on your return (including dependents)

- Prior year returns CANNOT be used to verify SSN

- Income documents (W-2, 1099s, Social Security income documents)

- Form 1095-A (if applicable)

- Recommended: Bank account and routing number (for direct deposit)

Single filers who earned less than $80,000 and non-single filers who earned less than $96,000 last year can use United Way’s Free Tax Preparation services. Some returns are too complex for their volunteers and the IRS prevents them from preparing certain types of tax returns. For example, they cannot prepare returns for income earned in states outside of Washington or returns that involve cryptocurrencies. Check the FAQ section on the United Way of King County’s Free Tax Prep website to make sure you qualify for services. If you are an international student or have an Individual Taxpayer Identification Number (ITIN) instead of a social security number, United Way volunteers can help. Translation services will also be available if you need them. An appointment is not necessary for in-person services.

The due date to file your taxes and for making tax payment is April 15, 2025.

United Way of King County's Free Tax Preparation Program is offered both virtually and in-person. Please visit their website for more information and additional locations.